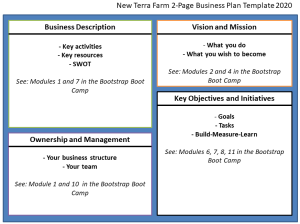

A business plan is an integral document for any start-up or small business, whether seeking investment capital or simply outlining goals

and objectives for yourself and the organization as a whole. While creating one can take some time and energy, writing it helps clarify ideas and direct energies toward long-term success for any venture.

First step of writing a business plan: Determine its purpose. Will this plan attract investors, unite teams or provide direction? Once you understand who the target audience is, start organizing your thoughts and researching accordingly.

Business plans need to cover an extensive amount of ground, but it is crucial that they keep their audience in mind throughout the writing process. Doing this will allow you to avoid using industry jargon or making assumptions about their knowledge base. Furthermore, having your plan reviewed by an outside expert before giving it out could also help keep readers on the same page with what is presented.

A good business plan should start off with an executive summary that introduces your company and describes its purpose. If you’re seeking investment capital, include how much money is necessary along with your plan for creating a return on investment. If using it to expand existing operations, describe target markets and marketing strategies.

Provide details of your product and its differentiation from competitors’ offerings. Investors and bankers look for companies that solve problems or fill gaps in the marketplace; so it’s essential that your organization can clearly articulate why it will succeed in doing so.

Your plan must include a section outlining financial projections three years into the future, to demonstrate your ability to control expenses and predict sales and profits accurately.

Include charts and graphs to visualize your data. This will make your plan more engaging for readers while communicating complex concepts such as your accounts receivable turnover ratio or projected profit margins more effectively.

Under Management and Organization, provide bios for each member of your key team and list their credentials and achievements that make them stand out among other business leaders. Also included should be details regarding your legal structure such as whether it’s a corporation, limited liability partnership or sole proprietorship.

Financial sections of your business plan should provide a detailed breakdown of current and projected revenues, income statements, cash-flow analysis and balance sheets. As this section can often be scrutinized by investors and lenders, be sure to include accurate and realistic numbers that have been reviewed by professionals beforehand – this will help avoid common errors like overstating projected revenue numbers or forgetting startup costs and hidden expenses that lead to costly errors later.