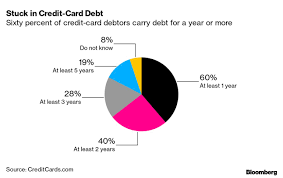

Credit card debt can be an effective tool, helping to build credit quickly and pay for necessary items quickly. But it can also be an enormous source of strain – according to recent data, the average American family credit card balance has hit record levels and delinquency has skyrocketed; therefore, it’s crucial that Americans understand how debt statistics work as well as what actions can be taken by themselves to change them.

In 2022, the average American household had an estimated credit card debt of $5,733, an increase from last year but significantly below its peak during the COVID-19 pandemic of 2020-2021. While this amount may seem high overall, not all age groups experience it equally – people between 40-49 have the highest average debt while those under 18 have some of the lowest balances.

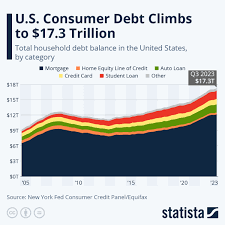

Note that credit card debt represents only a portion of total personal debt in America; other forms such as student loans and auto loans tend to be more widespread.

Income level is one of the key determinants of credit card balances; those with higher incomes tend to earn more and be approved for credit cards with ease, helping them keep up with payments more easily than people in lower income brackets, who may struggle with maintaining minimum monthly payments resulting in an ever-increasing outstanding balance over time.

Location can also have a big influence on credit card debt, as evidenced by data from WalletHub that shows average credit card debt

across each state is closely correlated with unemployment rate and cost of living; states with higher interest rates also typically have more debt.

No matter why a person may find themselves saddled with credit card debt, the most crucial step in taking action is talking to a credit counselor. A free credit counseling agency will have all of the tools and resources you need to tackle it successfully; from finding a repayment plan that fits with you to helping resolve issues with creditors.

Maintaining a positive relationship with your credit cards is key to eliminating debt. To do this, set up a regular financial check-in routine – even something as simple as scheduling 30 minutes each month to review all accounts, track progress and make any necessary adjustments – for instance if you receive an unexpected raise or have emergency expenses that require more of your income, such as increasing payments may be needed. By taking these steps you could soon join millions of Americans living debt free! Good luck and congratulations on being one! — By Mary Mackey from CNBC Make It