Manufacturing is an essential industry that fuels our economy and provides jobs. However, its start-up and operations can be

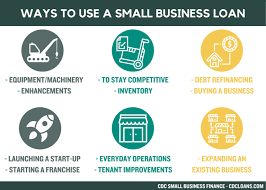

costly; therefore, small manufacturers require business loans in order to start up operations. There is an array of debt financing solutions available for small manufacturers including SBA loans, conventional bank loans, private-investment banks, factoring, equipment financing purchase order financing mid prime alternative loans as well as business cash advance financing – each will play its part. When considering your financing options it’s essential that you weigh them carefully so as to select one suitable for your company!

Working Capital

Manufacturing businesses frequently turn to business financing solutions for working capital needs. From paying inventory bills and payroll costs, to expenses such as marketing expenses or rent payments, this funding option helps address cash flow problems before they escalate further. Furthermore, many lenders provide this funding without the requirement of collateral such as real estate or valuable assets as security for this financing solution.

Equipment Financing

Manufacturing businesses rely heavily on machinery in order to meet production quotas and achieve success. While investing in new and advanced machinery may be costly, investing is essential for growth and success – hence why so many small manufacturers use business loan financing options when purchasing used and new machinery that will benefit their company for years to come.

Manufacturing companies incur considerable expenses when purchasing raw materials, with failure to secure sufficient supplies leading to delays in their manufacturing processes, costing both money and reputational damage. Luckily, manufacturing loan specialists offer financing options specifically for bulk orders of raw materials; that way you can be assured you’ll always have what’s necessary to produce quality products on schedule.

Manufacturing businesses frequently need business loan financing for facility expansion. As your company expands, its initial startup location may no longer meet demand and competition – meaning small business loans help manufacturing firms keep pace.

Finally, manufacturing business loans can also help your credit score as a manufacturer. By meeting all monthly loan payments on time and securing better loan terms in the future. Notably, some lenders require collateral as part of the loan agreement – such as manufacturing equipment or vehicles – as security for their loans. But the advantages outweigh any risks. To get started with manufacturing financing solutions on Connect2Capital, complete a simple application form. Within minutes you will know if you qualify and then choose an ideal lender partner to fund your manufacturing company.